The 2021 Housing market had an incredible year. The market was hot with record low interest rates, response from the global pandemic, and homeowners with increased savings from the government shut downs.

We explore some of the key data from 2021 compared to previous years to show what changed in the home building industry.

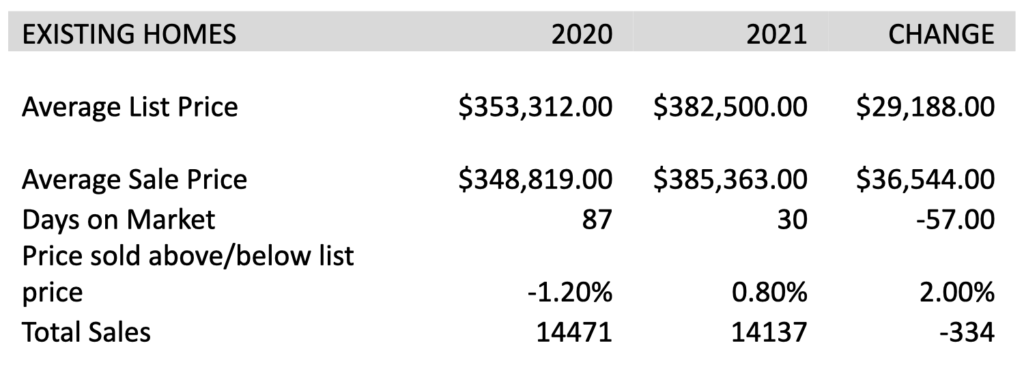

First, we studied the homes sale activity 7 County Market including Waukesha, Washington, Racine, Ozaukee, Jefferson, Dodge, and Walworth Counties through the Multiple Listing Service.

7 County Homes Sales Wisconsin

As you can see the average sale price leapt up 8.26% on existing homes and 7.4% on new homes. Average days on the market dropped significantly as well. While sales were down overall, this was due to lack of inventory. Supply and demand pushed pricing higher and what is most astonishing is that the average home sold for more than asking price in 2021. Builders struggled to keep product on the market and the long lag time to get new construction homes on the market kept inventory low.

As you can see the average sale price leapt up 8.26% on existing homes and 7.4% on new homes. Average days on the market dropped significantly as well. While sales were down overall, this was due to lack of inventory. Supply and demand pushed pricing higher and what is most astonishing is that the average home sold for more than asking price in 2021. Builders struggled to keep product on the market and the long lag time to get new construction homes on the market kept inventory low.

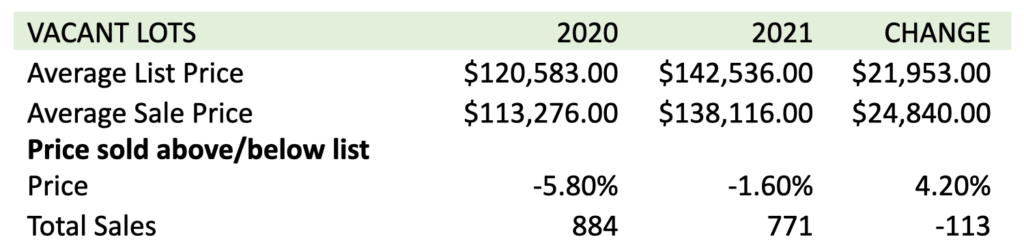

Now, let’s take a look at vacant lots in the 7 County Area.

As you can see, average list prices rose 18% in 2021 from the previous year. Average sale price increased by 21.9% indicating that lack of supply is putting upward pressure on lot pricing.

When combined, the increase in lot prices with the increase in new home costs showed a $78,000 increase in new home construction cost in 2021 whereas existing homes increased approximately $30,000 on average in the same area. The new average lot price on the market has leapt to $159,742!

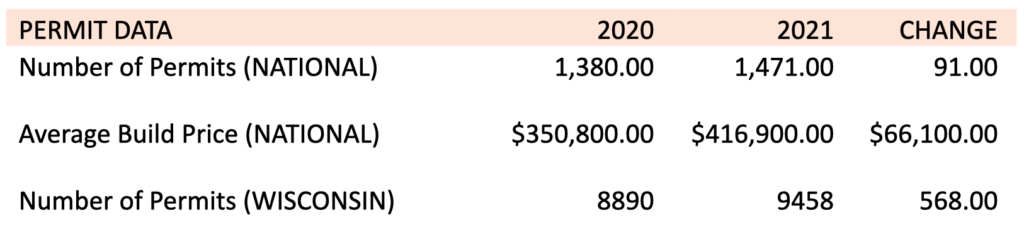

What about permits for new construction?

Nationally, the data for permits shows a 91,000 increase in building permits. Here in Wisconsin, permits were up 6% for the year with 568 new projects applied for.

Another staggering thing to note is that in 2020, only around 1100 lots were created in the 7 county areas whereas over 2300 homes were permitted. This indicates that a lot shortage could be happening and further evidence of why lot prices are climbing significantly.

One other interesting point to note is that the National Association of Home Builders tracks housing affordability. Affordability index dropped 20 points in 2021 and home buyers were spending 2% more on the home payment as percent of their income.

In conclusion…

Housing affordability should be at the forefront of discussion with all elected officials as this continues to be a major issue in the marketplace. Long approval processes for new developments, high minimums, and limited flexibility on density need to be further explored.

Overall, the 2021 housing market was one of the best ever. However, the supply chain issues, lack of labor, and spike in lumber prices hampered new construction activity in 2021.