2018 is about to close and it was a strong year for buying, selling, and building homes in Wisconsin.

Here is a brief look back on housing in 2018. November home sales are up from the previous year in Wisconsin and the median price increased 7.7% from the previous year. This is due to a lack of inventory on the market. Currently in Wisconsin we sit at four months of inventory which is well below a “healthy market” of 6 months.

Even though market conditions are strong for housing in 2018, sales overall were down for the year because of the thin inventory. Especially in the $300,000 and under market.

Now it is time to look ahead the 2019 Housing Market Forecast.

2019 is expected to be a solid housing market. There are several indicators that will continue to drive the market. We do not expect 2019 to as strong as 2018 due to rising interest rates and affordability concerns but it is still going to be a good market to build or buy a home.

First off people are working, in Wisconsin unemployment is at 2.8% and Nationally it is at 3.7%. When people work, they have money to buy. Since there is a labor shortage, the average income is up 3.4% so people have more money to spend or trade up on their homes. The challenge is that affordability is down due to rising prices of new construction, rising prices of existing homes, and higher interest rates.

The bottom line is you will still be able to sell your home fairly quickly, especially if it is under $350,000 but any new home you purchase will likely cost you more.

We expect home starts to be strong again in 2019. In 2018 through October there were 1,228,000 home starts which is already over the total for 2017. That is a good sign. We don’t expect homes starts to grow as much in 2019 due to rising prices, labor shortages, and land shortages.

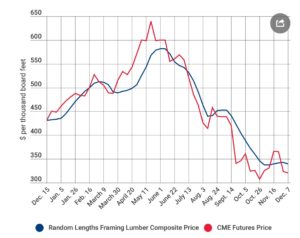

Material prices will continue to hamper affordability. While lumber prices have declined to normal levels of $350 per thousand board feet from their extreme highs in May of 2018 of nearly $600 per thousand board feet, many other commodities have seen significant increases. One of which is the proposed 25% tariff on Chinese goods. This pricing has already hit our markets but with recent news of it being postponed for more negotiation, we will need to watch what happens in the 1st quarter with pricing. Many goods such as light fixtures, appliances, quartz tops, framing nails, and home electronics have seen significant bumps in pricing.

Framing Lumber:

Source: National Association of Home Builders

Labor is still a major concern and with a lack of skilled labor existing firms have increased their prices to keep their skilled workers and then passed those costs on to their builders.

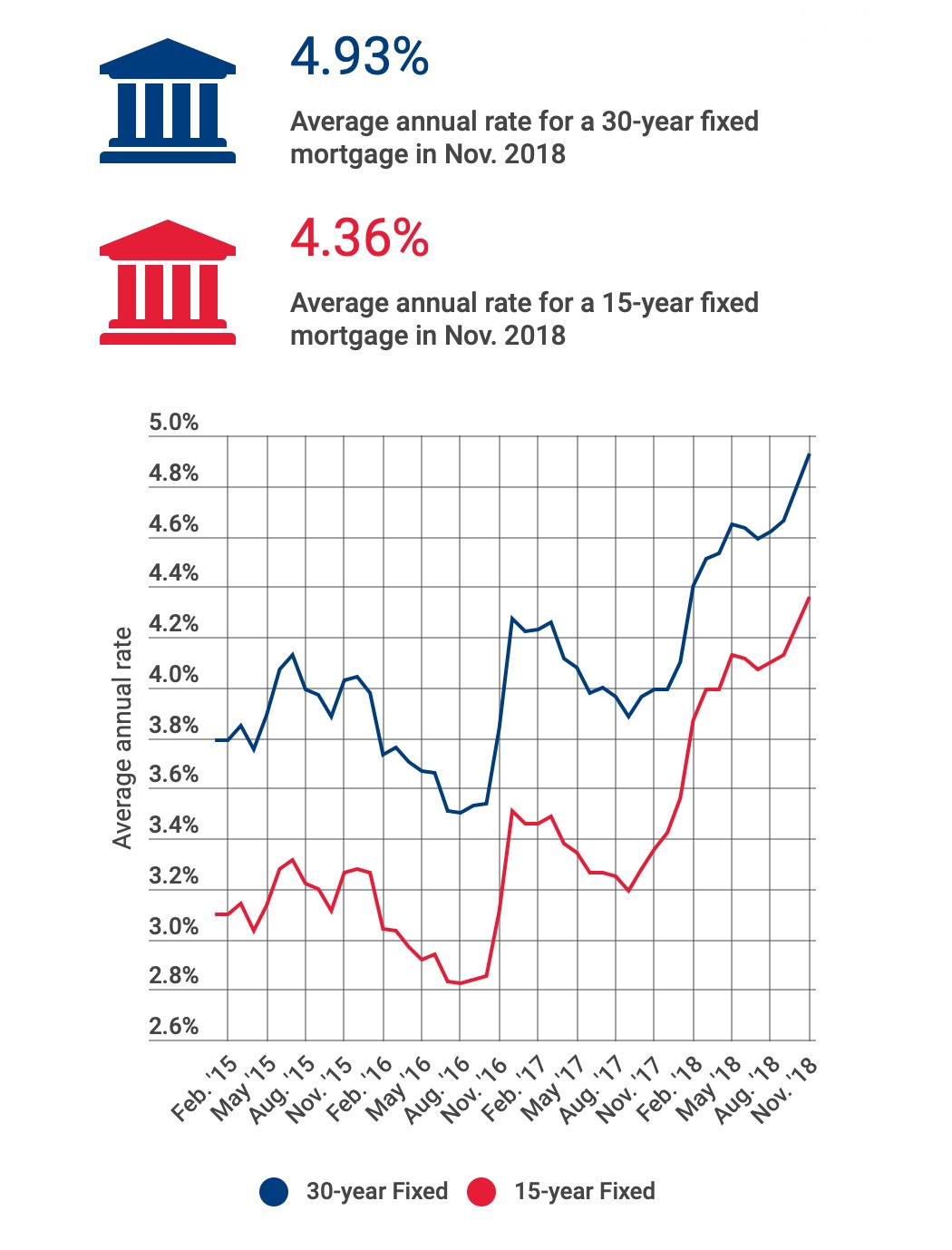

As far as mortgages, as of the time of this article the 30-year fixed mortgage was around 4.93% which is up about 1% for the 2018 year. The FED has indicated that rates will increase again next year but they may pause hikes for a while as the stock market has been more volatile recently. Inflation will end the year around 2% so as long as that does not creep up higher rates should hold for a bit. Experts predict rates will end the 2019 year between 5% and 5.3%. While historically low, the days of the under 4% mortgage are over.

2018 Interest Rates

Source: National Association of Home Builders

We do expect a bump in home purchases early in 2019, especially when people see the increased income in their pockets from the Federal Tax cuts.

For those that own a home it is going to be a great time to sell and trade up, just expect to pay a bit more for you new home. For first time home buyers, it is going to be a challenge getting a property at a low price. Buyers in this market need to be pre-approved, write above asking price, and ready to jump as soon as they find something they like.

The two largest segments of the population will define the housing market in the next few years according toRealtor.com:

“Noted that Millennials will continue to make up the largest segment of homebuyers in 2019, and account for 45% of all mortgages, compared with 17% of Baby Boomers and 37% of Gen Xers.”

Expect the boomers to downsize and move to condos or smaller homes and for the Millennials to purchase some of these homes up.